How many times have you been left unhappy with the way you divide common expenses with friends or roommates? How many times have you preferred to pay more, or less, than you owed to avoid tracking transactions, and looking for receipts? How many times have you done it to avoid conflicts and confrontations?

Generally speaking talking about money, outside business conversations is considered to be inappropriate. We treat money and finances as very personal subjects, even private. But sometimes sharing financial information is not only necessary, but beneficial.

Share your budgets and expenses

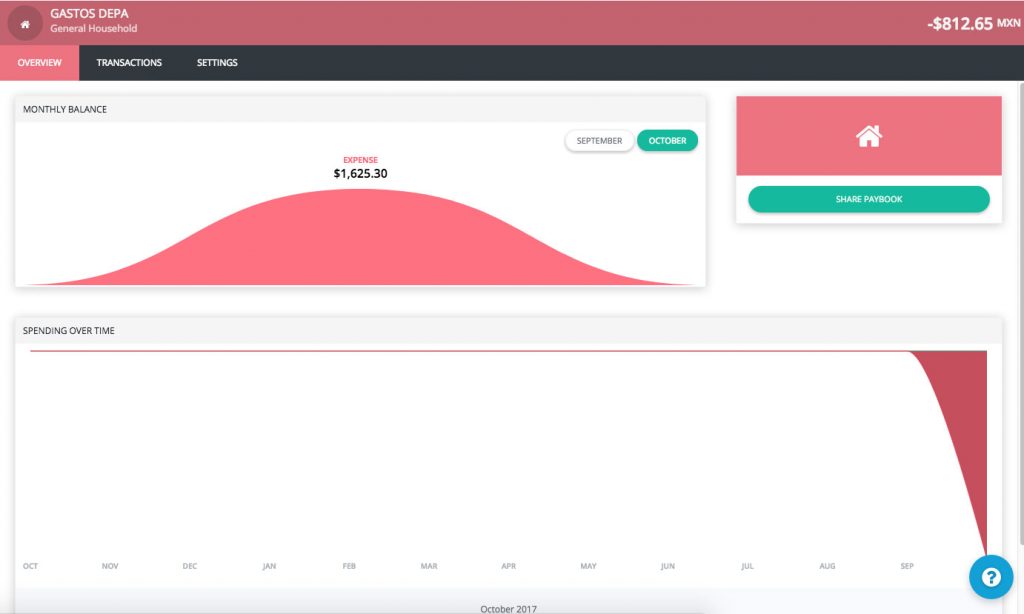

From your Personal Glass account you can create and share Paybooks with other Glass users. For example, you can create a PayBook to manage all your apartment’s utilities, and share it with your roommates; or you could use a PayBook to organize and consolidate everything you and your friends spent on the weekend trip to Acapulco, and then share the expenses accordingly.

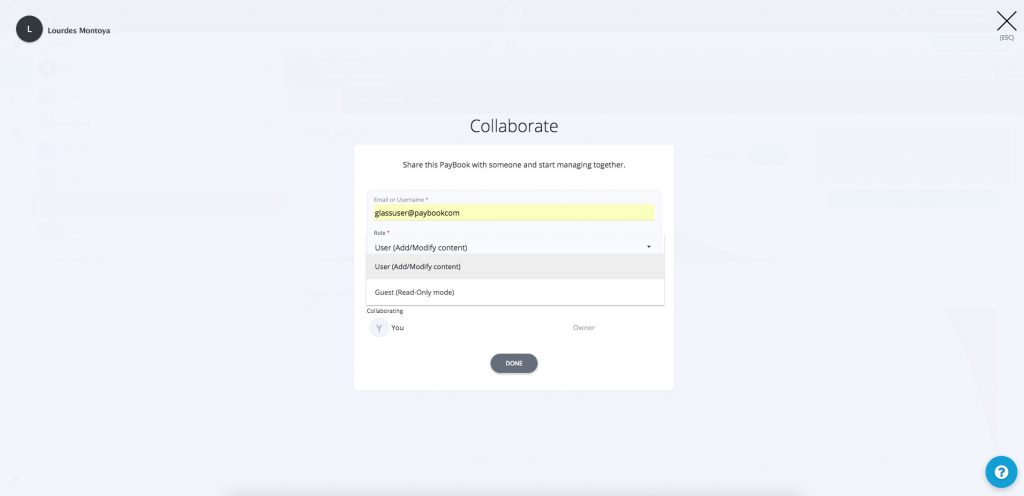

It’s really simple: you only need to create a PayBook with all the transactions you choose, decide with whom you want to share it, and then click on the “Sharing” button. You can specify if these users can collaborate by adding transactions of their own and adding tags to yours, or only view the your information, without being able to edit it.

Users that received the shared PayBooks will have access to them in their own Glass account, on the Sharing section.

Share your company’s daily numbers

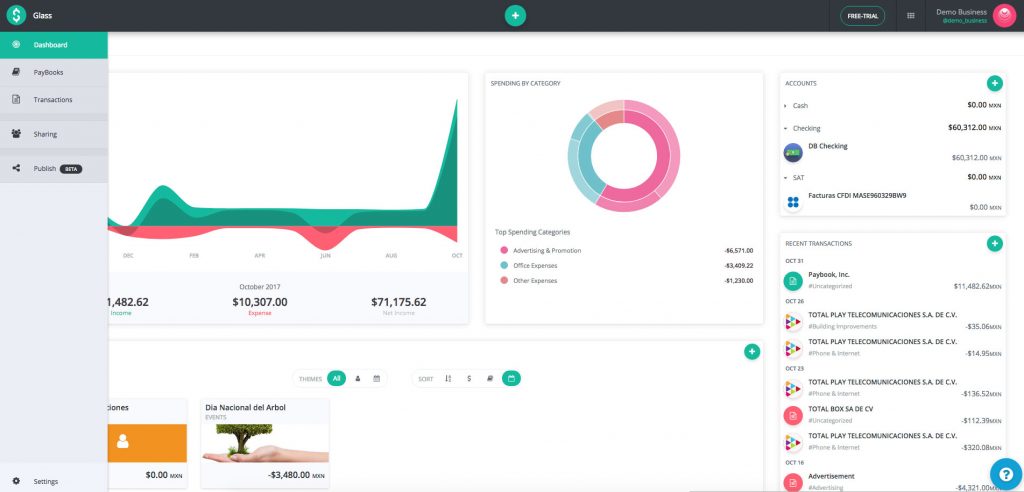

Administrative and financial control inside a business involve a whole team of people, with different degrees of control, and different levels of access to information.

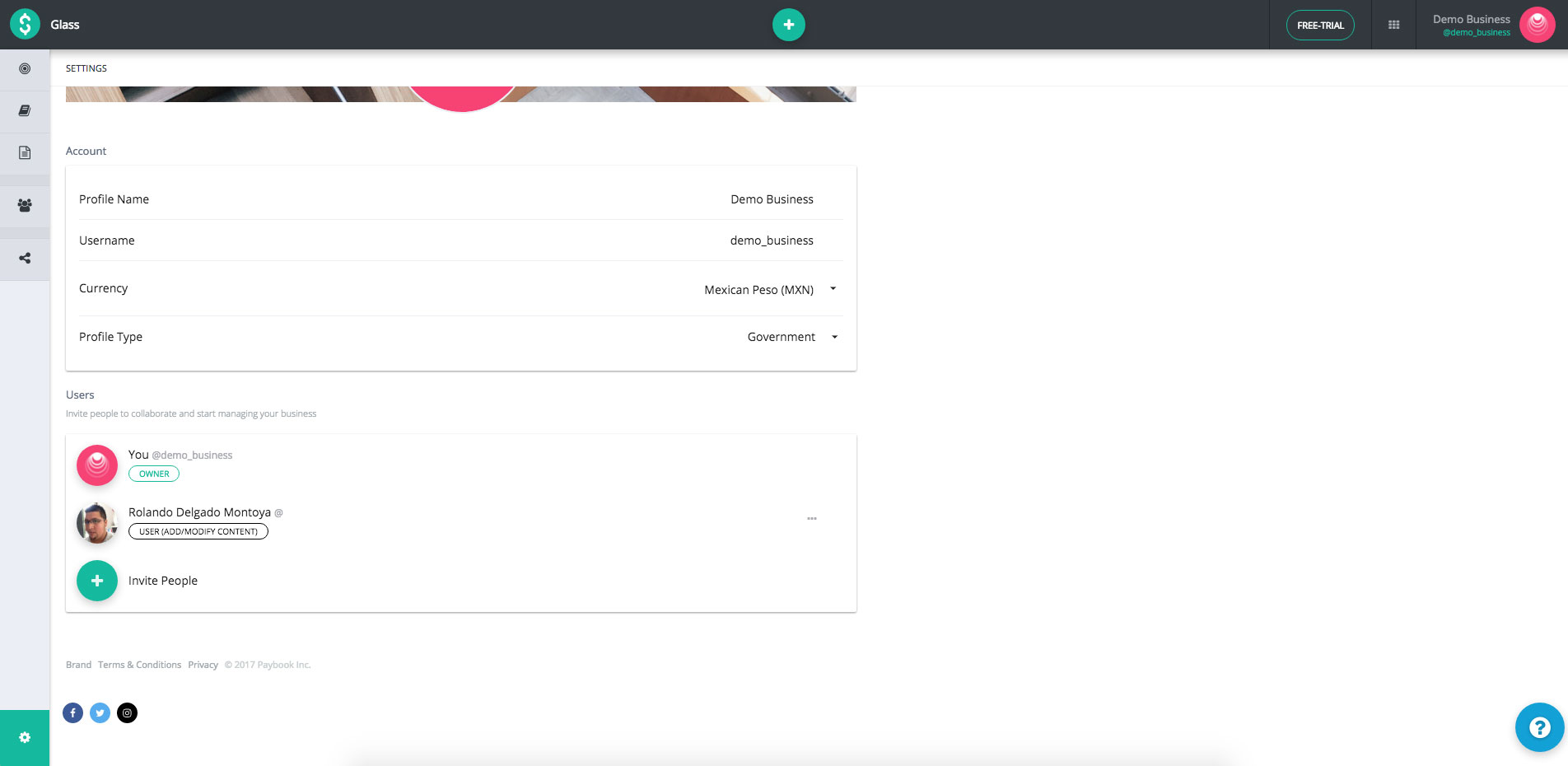

With Glass Business, you get the same sharing modes that you have on your personal account; for example,you could create PayBooks for specific budgets per area, or sales reps could manage their expenses with one, and share it with management. Glass Business also has another sharing mode, in which you can share your whole Business profile with other users. It’s ideal for business partners with a shared account, or to share daily information with your accountant.

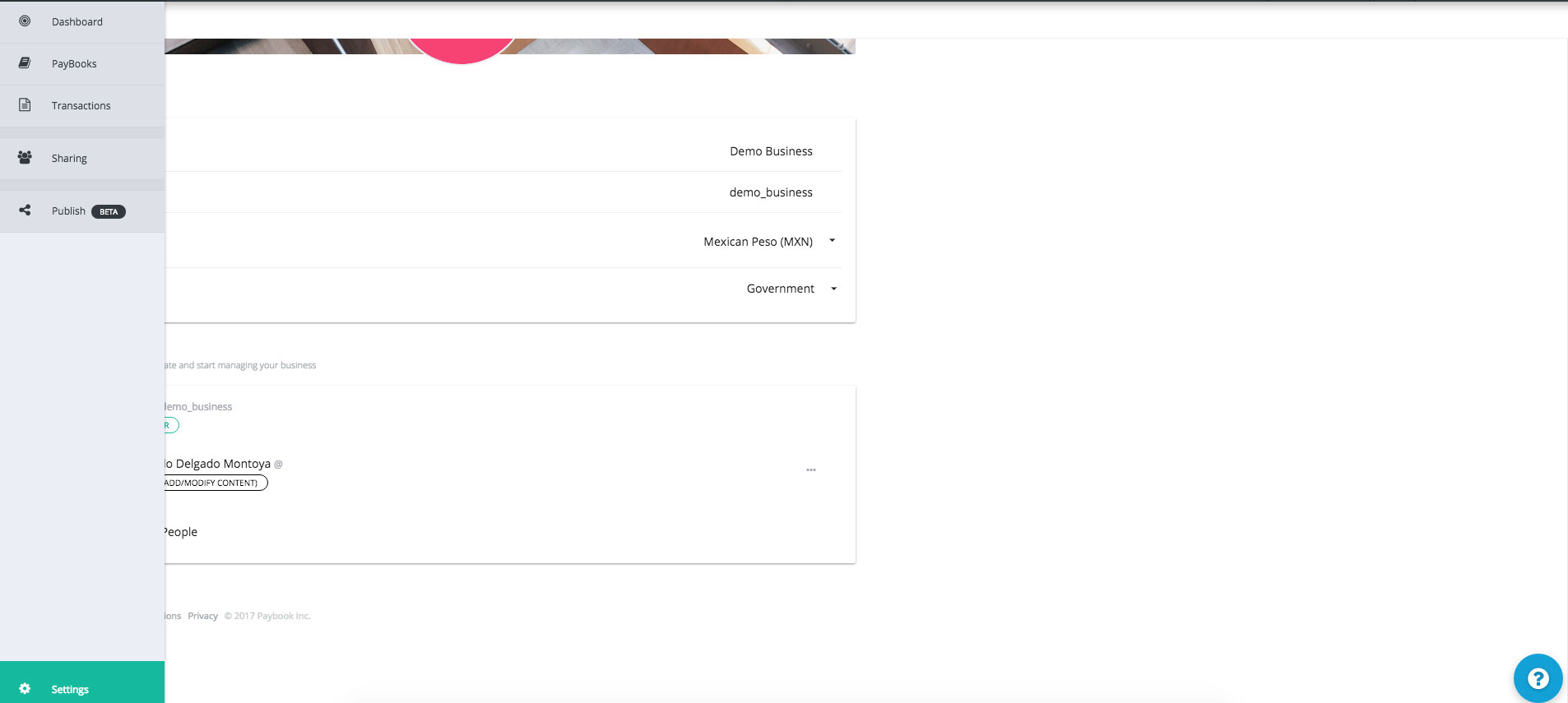

On your Business profile, on the “Settings” section, you’ll find the subsection “Users”, where the “Invite people to collaborate and start managing your business” option is located. By selecting this option, you will grant access to the users of your choosing to your profile; depending on what sharing mode you choose, these users will be able to manage your whole profile, or only to view it.

Either as an auditing tool, or as managerial support, you won’t have to wait to the end of the month to get your financial reports. With Glass Business, you have all the information you need, at the moment you want it.

Embrace financial transparency

Being money and finance such delicate subjects, you may ask yourself: why would someone choose to make their finances a public affair? There are many lifestyles and professions out there, all with different needs and challenges. Glass Social is a sharing mode that allows you to make your Glass Business profile, and the information contained in it, completely public.

In this sharing mode everyone, not only Glass users, will have access to the financial transactions on your Glass account. Glass Social is ideal for example, for public finance administration, or to follow-up your donations to nonprofit organizations.

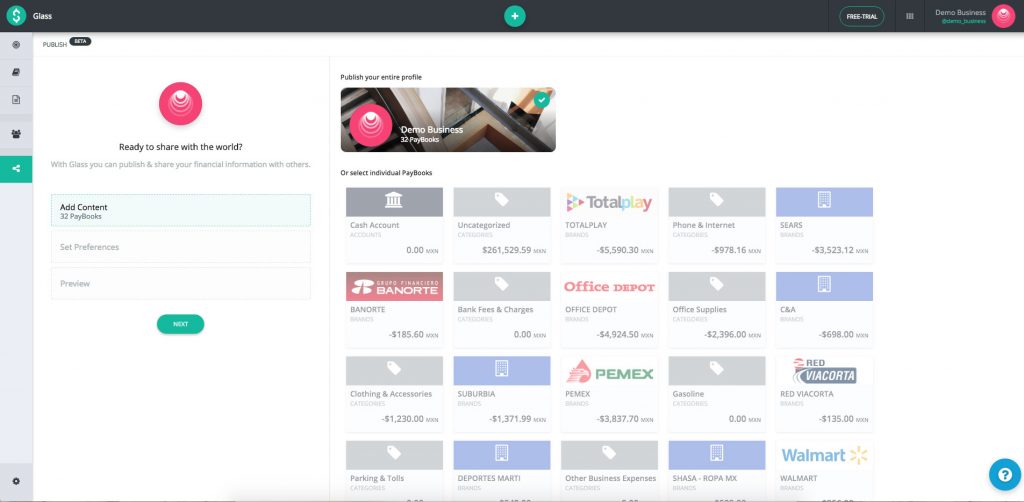

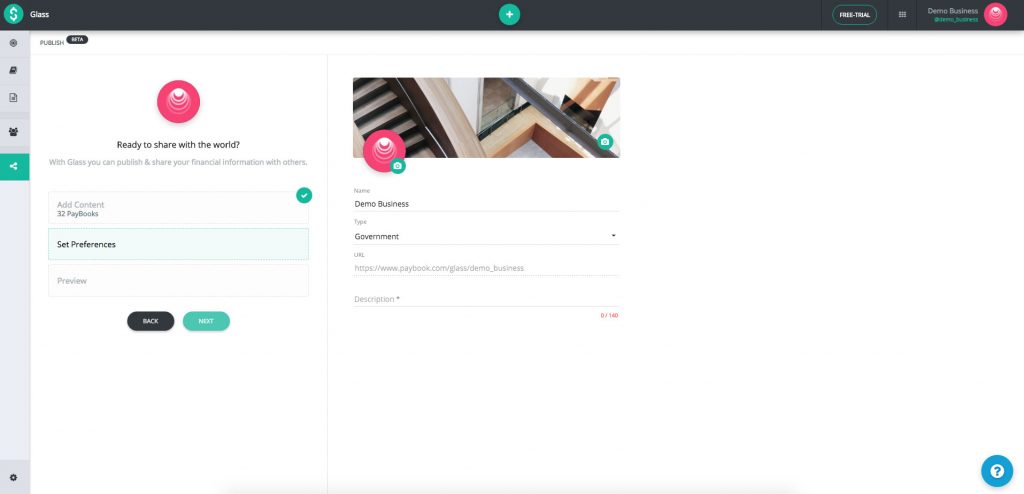

On the “Publish” section you will find publishing options: would you like to make all your profile public? Would you rather publish only one, or a few of your PayBooks? In this section you can decide. You can also set up your preferences like your business name, your URL, the type of profile you are publishing (business, public figure, non profit, etc.), and a brief description of the profile that is being published.

After you have established your preferences, you have the option of a preview of your profile, before going public.

Either for business purposes, for legitimizing nonprofit or government managerial practices; or even just for showing what you can accomplish within an established budget, Glass Social offers you the best solution.

Financial transactions concern more than just the person that makes them; every transaction we make connects us with other people and different commercial entities. Be it for personal or interpersonal finances, to optimize business processes, or to show the world how we manage our money, Glass, in all of its versions, makes sharing and collaborating simple and easy.

No more extended sessions of expense tracking, no more waiting for monthly financial reports; log on your Glass account and with only a few clicks discover the benefits of real-time collaboration.

Leave a Reply